ZATCA Regulations for E-Invoicing

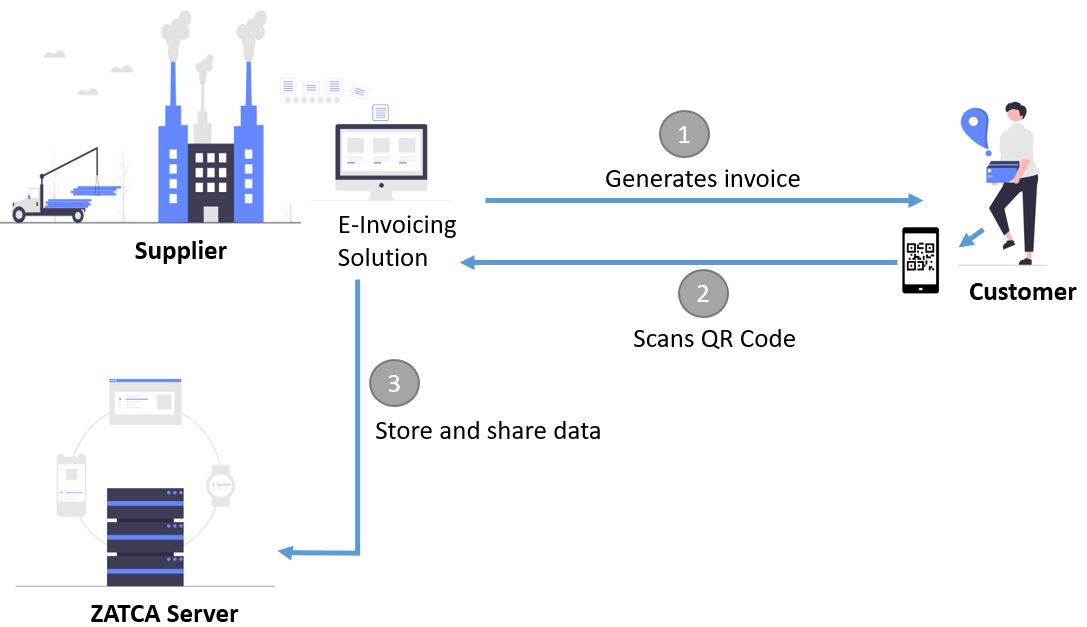

All taxable businesses are required to generate E-Invoices in compliance with ZATCA regulations.

An E-invoicing solution must fulfill the following technical requirements:

-

An online system for generating e-invoices with transactional data and special key fields

(UUID, Cryptographic stamp with identifier, and QR Code) to regulated data exchange with state-of-the-art security standards.

-

Data authenticity and integrity must be guaranteed for all electronic invoices, debit, and credit notes.

-

A compliant solution must not include text editing tools, spreadsheets, or any other bookkeeping/archiving software.

-

Integration with ZATCA E-Invoicing portal through recommended Application Programmable Interface (API) must be supported.